MMTLP: The making of a short squeeze.

Yes, I know, short squeeze has become a cringeworthy term in many investing circles, synonymous with names like Gamestop and AMC, but hold your judgement for two minutes…..

I invest in the fundamental of companies, while keeping an eye on technical analysis. I am a long-term holder of companies I buy, yet, in the past two years I have owned three companies that had a demonstrable short squeeze, Metamaterials, Torchlight and Microvision. Now a fourth potential squeeze has presented itself: MMTLP. This is the special dividend that resulted from the merger of Metamaterials and Torchlight. It was never meant to trade publicly, and the story about how it ended up getting listed and by whom reads like fiction.

For this I will stick to just the facts.

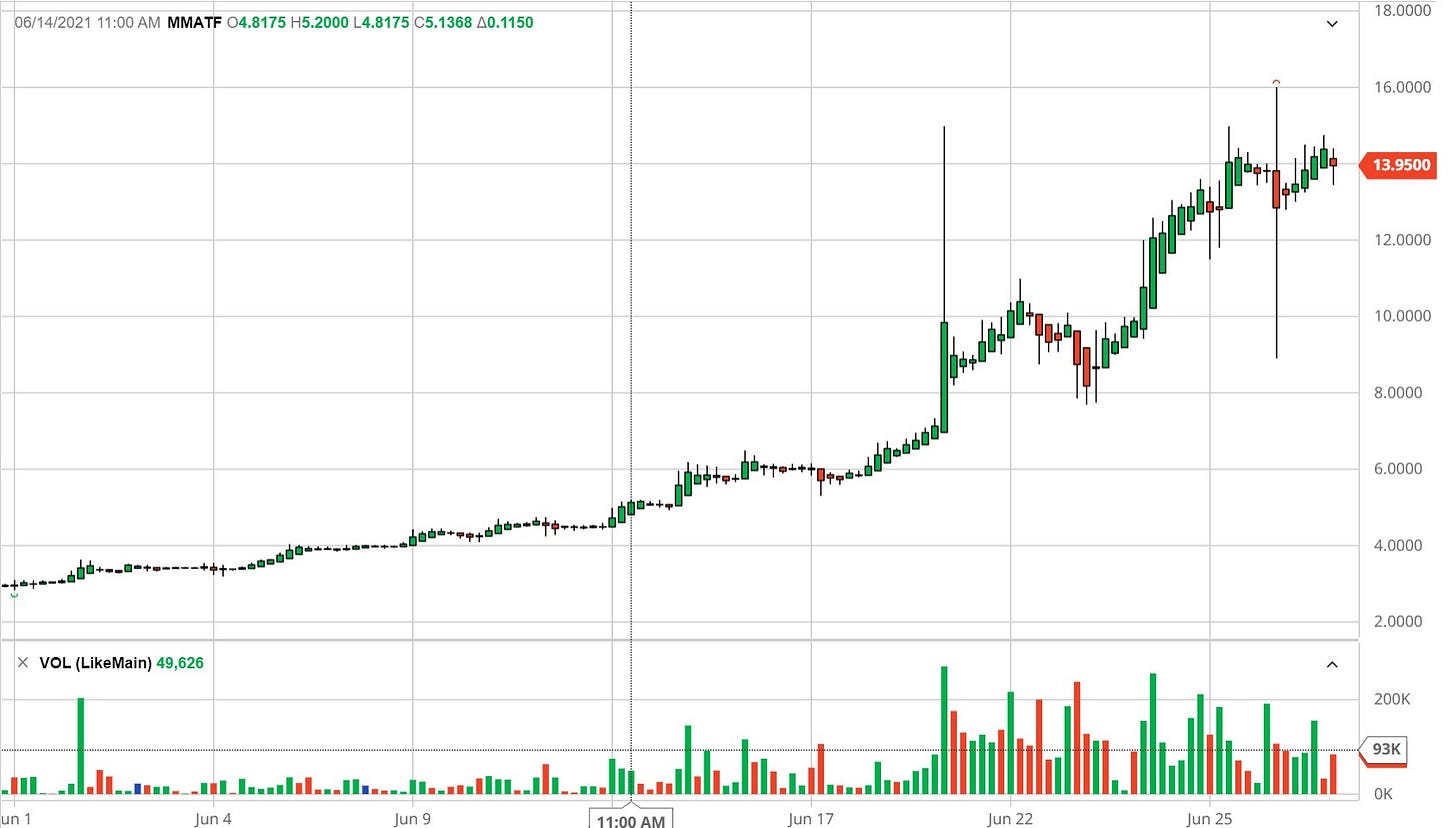

Squeezes are typically the result of heavily shorted stocks coming into contact with a positive catalyst. In the case of GME and AMC, it was a group of people realizing that a company had a greater value than its share price at the time with an extreme amount of shares held short. This group was stubborn and committed to making the shorts buy back the shares at much greater prices. It was following these two short squeezes that idea became mainstream. It was also about the same time that Metamaterials ($MMATF), a smart material and nanocomposite company agreed to merge with Torchlight Energy, an oil and gas company. The agreement would put Metamaterials on the Nasdaq and Torchlight would divest their oil and gas assets. It was around this time (02/19/2021) that I publicly announced that I was buying shares in both companies, MMATF was at $2.20 and TRCH was at $3.02. By the time the actual merger rolled around Torchlight had hit $10.88, before falling back to $4.93 and Metamaterials had closed at $13.95. To add more math to the pile the MMATF shares were given 1.845 times the shares in the new listing MMAT, so you can say the peak of MMATF was closer to $18.

Take a look below at the MMATF and TRCH charts here, you can see the squeeze and the only thing I can promise here, volatility.

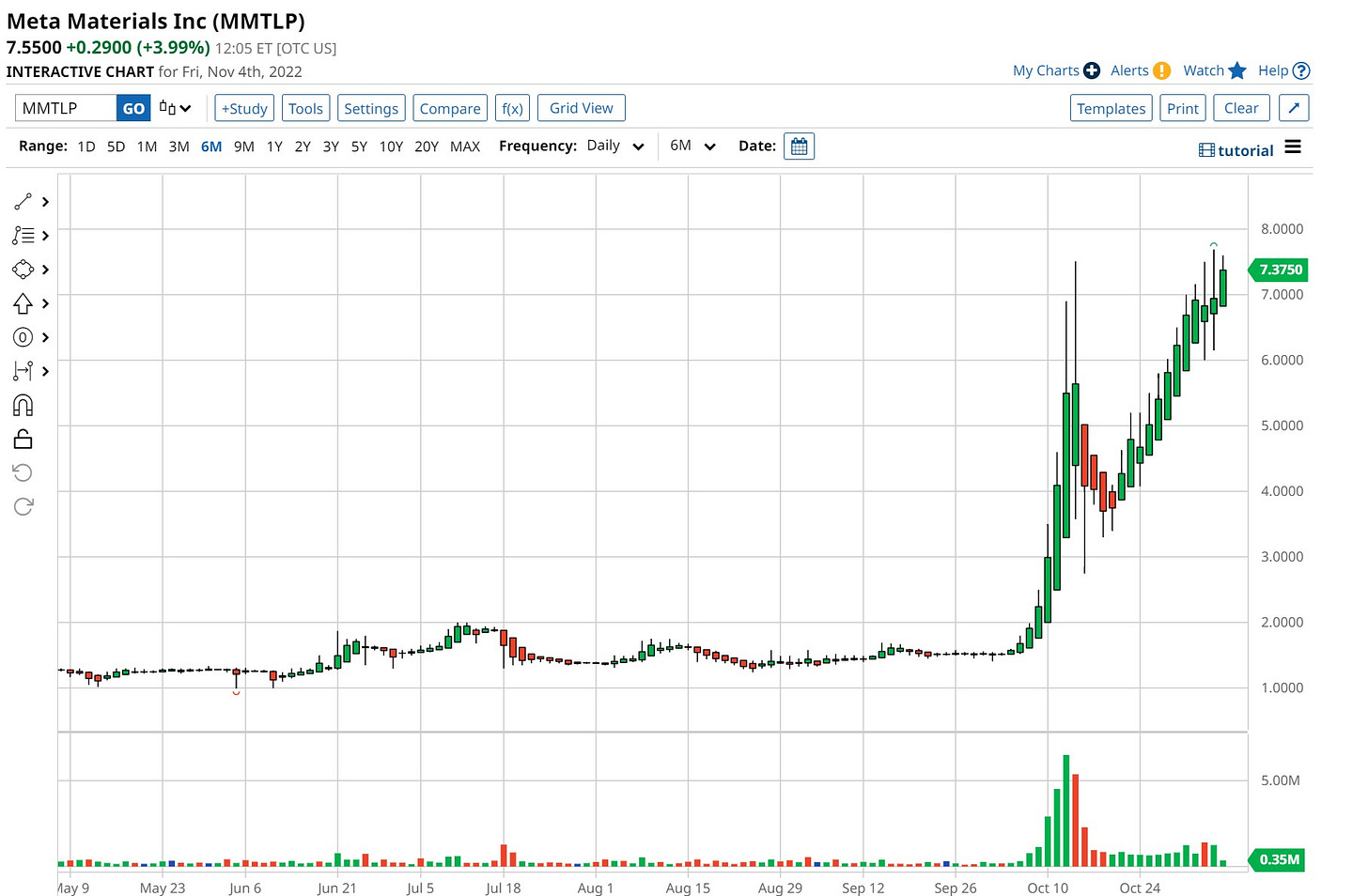

Why am I telling you this? Because the same shareholders that saw the potential in weird merger and high short positions involved in MMATF/TRCH are the holders of these MMTLP shares and the case for a squeeze is even better. Insiders are said to own about 1/3 of the float and I have not seen a single report of them selling any.

As of 10.14.2022 (the most recent short report) a whopping 6,592,406 shares were shown to be held short. It is widely believed that many millions more synthetic and international shares are held short, and while that would certainly increase buying to close those positions, I’ll assume that only the 6.5m+ shares are held short. With the average volume of a little less than 763k, it would take (under normal volume circumstances), more than 8.6 trading days for the shorts to buy them back.

Why would they buy them back? Because they won’t have a choice. The company has submitted an S-1 with the SEC in order to take the assets private. I believe this was done solely to make the shorts cover, but it really doesn’t matter. So long as the S1 is approved, the company will go private, and you cannot have a short position in a private company. The brokerages should then force those positions closed, creating a lot of buy side volume.

Overstock.com

Has this ever happened before, you ask. The best parallel that I can find is the Overstock.com digital dividend. Back in April of 2020, the CEO felt that the company had been shorted well below its true value and orchestrated a plan to push out the shorts. $OSTK was trading around the $5 mark when they announced that they would be giving out a digital dividend. By August of 2020 it had peaked at $128 because no one could figure out how to short a digital dividend.

Here is the past month of trading on MMTLP, as you can see it has been volatile! So far it has put in a high of $7.51 before a short report came out and pushed it almost to $3.50. I anticipate that there will be more short attacks, especially is the S-1 needs another change before approval. I think in the end that MMTLP shareholders will get another run.

High Expectations

So, what are the underlying assets of the soon to be private company, NextBridge Hydrocarbons worth? Nobody knows, and from my point of view no one needs to. There are a lot of people saying that the oil and gas assets in the Orogrande are worth many billions, ever the contrarian, my guess is much lower. Having a large group of people dedicated to the squeeze, many with a zero cost-basis, can only increase the odds of success and the recent run above $7 has drawn even more attention.

The beauty of a short squeeze is the detachment from the fundamentals. This is also the reason that I don’t think of these types of plays as investments. I enjoy them and I play them, but they are like a game of musical chairs. No one knows when the music will stop, or if there will be a shocking plot twist. Not everyone is looking to sell, but I will be, and we can’t all sell at the same time. So, I only put in money that I can afford to lose, and I make sure to de-risk as soon as possible, so I can enjoy the ride no matter the outcome.

All signs are pointing to a squeeze, and when they happen, they can provide an excellent return. If you choose to play along, do it smartly.

I do thank you for your reply to my comment. A lot has changed in those 1 1/2 years. Tech. and government policies, both have made oil and gas gold. We now have the resources to go after the 3.2-3.7 billion barrels of oil and gas equivalents. Big oil companies want what we got big time. We know what we hold.

I'm one of those zero cost holders and am holding strong.