Medicenna: Biotech's Breakthrough Bargain in Cancer Therapy.

Revolutionizing cancer treatment with groundbreaking IL-2 therapy.

The biotech sector has been on a rollercoaster, recently plunging in response to RFK Jr.'s appointment as Secretary of Health and Human Services. While the market reacted emotionally, savvy investors know this is often the best time to find undervalued gems—and Medicenna Therapeutics (US: MDNAF 0.00%↑ | CAD: MDNA ) is shining brightly at just $1.11 per share, with a market cap of $84.84 million.

What makes this company special? Let’s dive into their revolutionary platform, breakthrough results, and why RFK Jr.’s leadership might be the catalyst that propels this small-cap biotech to center stage.

MDNAF 0.00%↑ 1-year chart

MDNA11: The Crown Jewel

Medicenna’s flagship program, MDNA11, is not just another IL-2-based immunotherapy—it’s potentially the best-in-class. Designed to supercharge the immune system to target and eliminate tumors, this next-generation IL-2 Superkine is delivering jaw-dropping results.

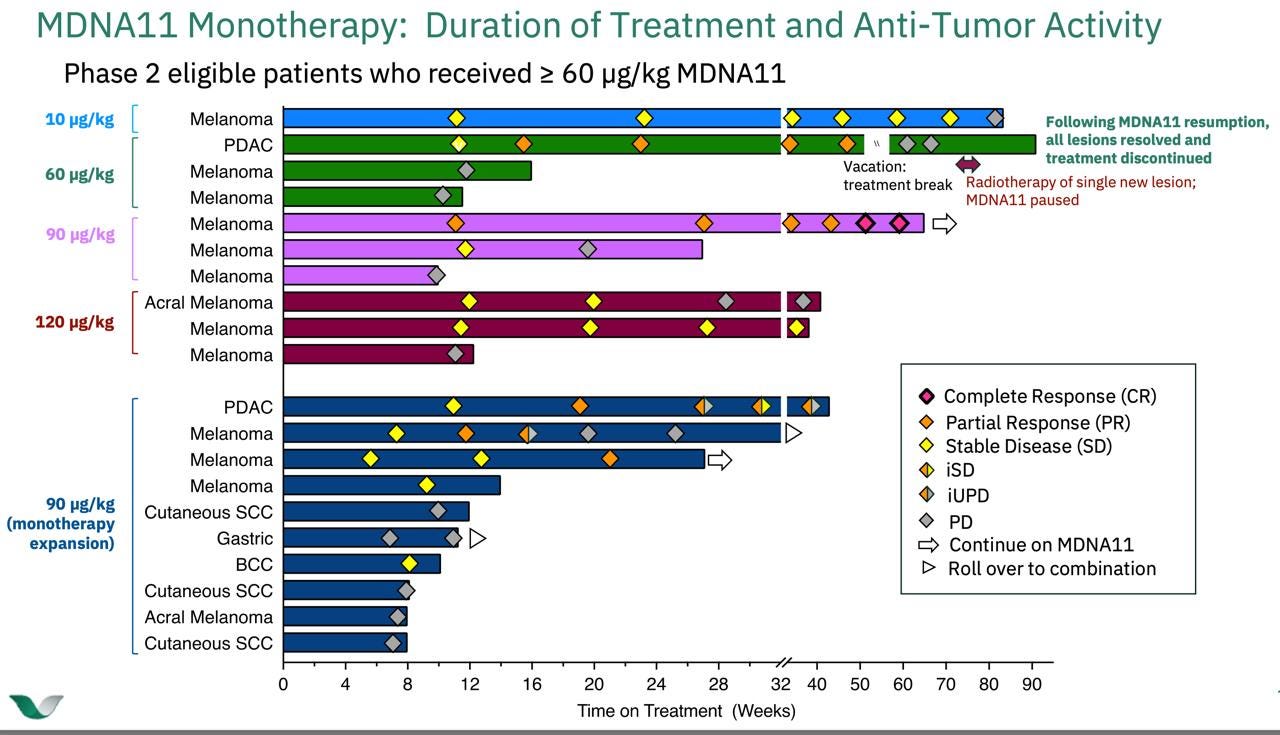

Complete tumor regression in both a pancreatic cancer patient (a notoriously lethal diagnosis) and a melanoma patient.

A 30% response rate in patients who had failed other immunotherapies, including checkpoint inhibitors like Keytruda—the world's top-selling drug.

Durable remissions with one patient remaining tumor-free for nine months after stopping treatment.

These results transcend typical progress in oncology treatments. Medicenna is showing us that MDNA11 can achieve responses where other therapies have failed.

Licensing Deals Paint a Bright Future

The IL-2 space has seen multi-billion-dollar deals in recent years, often for assets in earlier stages than MDNA11:

Synthorx was acquired by Sanofi for $2.5 billion in 2019, despite being in Phase 1 trials.

Nektar’s bempegaldesleukin secured a $3.6 billion licensing deal with Bristol-Myers Squibb before showing single-agent activity.

By comparison, Medicenna’s MDNA11 has already demonstrated efficacy as a monotherapy and in combination with checkpoint inhibitors, putting it lightyears ahead of many competitors at similar or higher valuations. Most importantly, they are ahead of where both Synthorx and Nektar were when their transactions occurred.

At a Synthorx-like deal of $2.5 billion, would bring in $23.76 per share, nearly 20x the current price. (2.5b/105.2m fully diluted share count). And a deal the size of Nektar’s would be worth $34.22 per share.

Medicenna is very well positioned to create licensing deals with multiple players in the IL-2 space.

These IL-2 drugs are very big business, with Keytruda bringing in over 27 billion dollars annually. Medicenna could have MDNA11 fast-tracked for standalone use. Testing on healthier patients may yield even better outcomes.

Beyond MDNA11: A Pipeline of Possibilities

What makes Medicenna truly compelling is that MDNA11 is just one of many assets in their robust platform. The company is leveraging interleukins from the IL-2, IL-4, and IL-13 families to create therapies targeting over 2,000 diseases, spanning oncology, autoimmune disorders, and more.

This diversified approach not only de-risks their business model but opens the door to countless licensing and collaboration opportunities, creating multiple potential revenue streams.

Solid Financial Backing

Medicenna’s $30 million cash balance, reported in November 2024, provides a financial runway into mid-2026. This robust cash position ensures stability for ongoing clinical trials, including MDNA11, and positions the company to negotiate partnerships or licensing deals from a position of strength.

A Biotech Tailwind: RFK Jr.’s Appointment

While the market panicked at RFK Jr.’s selection, his emphasis on streamlining FDA approvals and evidence-based medicine could be a boon for smaller, innovative biotechs like Medicenna. Faster approvals and less red tape mean that breakthrough therapies like MDNA11 could reach patients—and revenues—sooner than anticipated.

Given RFK Jr.’s known focus on challenging Big Pharma dominance, the era of small biotech innovators might just be beginning.

The Takeaway: A High-Risk, High-Reward Bet on the Future

Biotech investing is never without risk, but Medicenna stands out as a rare opportunity:

Undervalued stock: Trading at a bargain $1.11, the company’s potential far exceeds its current $84.84 million market cap.

Revolutionary platform: MDNA11 isn’t just a product—it’s a potentially curative approach to cancer and a gateway to an array of high-value therapeutic markets.

Imminent catalysts: With additional trial data and potential partnerships on the horizon, the next 12 months could redefine Medicenna’s trajectory.

Closing Thought

Medicenna Therapeutics may be trading like a penny stock today, but it’s delivering blockbuster results. With a robust pipeline, breakthrough therapies, and a favorable regulatory shift on the horizon, the question isn’t if MDNA11 changes the cancer treatment landscape, but when.

The opportunity is here—will Medicenna be your next biotech success story?

I recommend watching my latest interview with CEO Fahar Merchant :

And if you really want to get into the mechanics of MDNA11 and hear about their whole platform, there are older videos on my YouTube account that really get into it. StockTherapywithPennyQueen .

On X.com you may also want to check out Tweets by @Gantosj who has a solid understanding of MDNA.

Disclaimer

I have personally taken a stock ownership position in the company via the open market. *I have not been paid for this content.*

I do not provide personal investment advice, and I am not a qualified licensed investment advisor. All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read and/or view.