As we approach 2025, LEEF Brands emerges as a standout opportunity in the cannabis sector. With a unique combination of robust revenues, undervaluation, operational efficiency, and forward-thinking strategies, LEEF is positioned to achieve a pivotal breakthrough. Despite being a departure from my usual focus on clean or disruptive tech, this California-based cannabis company checks all the boxes for a strong investment opportunity.

Here’s why LEEF Brands is one of my top picks for 2025.

A Strong Foundation: The Santa Barbara Ranch

LEEF Brands’ nearly 2,000-acre ranch in Santa Barbara County is a cornerstone of its operations and future profitability. LEEF has a market cap just north of 25 million USD, the ranch alone could rival the company’s market capitalization. This asset is not just a piece of land—it’s a transformative resource.

Key Benefits of the Ranch:

Cost Reduction: LEEF currently purchases cannabis material at $25 per pound. By cultivating their own supply, costs are expected to drop to $8-$15 per pound, significantly boosting margins.

Supply Chain Stability: The ranch provides a reliable, high-quality supply of cannabis, eliminating reliance on external farms and ensuring steady production.

Expansion Potential: With a 187 -acre land-use permit in place and the first 65 acres set to be cultivated in 2025, the ranch offers room for future growth and scalability.

CEO Micah Anderson describes the ranch as transformational for the company:

"The ranch allows us to control our supply chain, reduce costs, and focus on genetic optimization. It’s the foundation of our strategy to increase efficiency and profitability."

Why LEEF is Undervalued

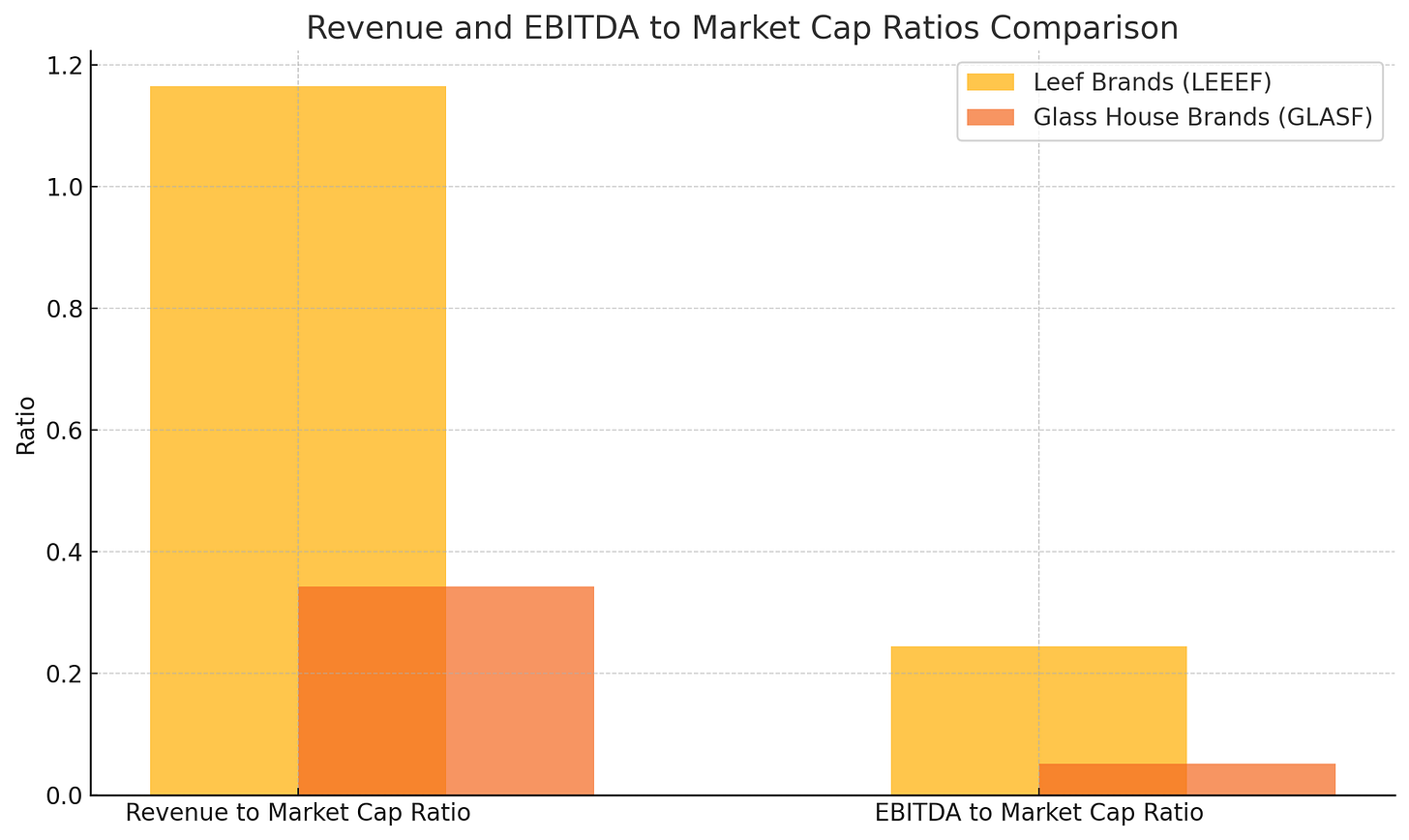

LEEF Brands is currently trading at just 1x revenue and 5.5x EBITDA, a stark contrast to competitors like Glass House Brands, which trade at 3.5x revenue and 20x EBITDA. LEEF just isn’t getting credit for their consistent revenue and EBITDA and this valuation disparity highlights an extraordinary opportunity for investors.

Key Insights:

Revenue Efficiency: Leef Brands generates $1.17 of revenue per dollar of market cap, significantly higher than Glass House’s $0.34.

Profit Efficiency: Leef Brands also outperforms Glass House in EBITDA efficiency, with $0.24 of EBITDA per dollar of market cap compared to Glass House’s $0.05.

Valuation Gap: Despite Glass House's larger absolute numbers, Leef Brands offers more favorable ratios for revenue and profitability relative to its market valuation.

LEEF’s $30M annual revenue and track record of resilience in California—one of the most competitive cannabis markets—underscore its potential. The addition of the Santa Barbara ranch, alongside operational and technological improvements, positions LEEF to unlock significant value in 2025.Catalysts for Margin Expansion

Margin expansion is a central theme for LEEF in 2025. The company has outlined several strategies to improve profitability, including:

Lower Cost of Goods: The Santa Barbara ranch will enable LEEF to reduce material costs by about 50%, directly enhancing margins.

Technological Advances: LEEF has hinted at proprietary innovations that could further increase efficiency and output, though details remain under wraps.

Increased Capacity Utilization: With processing facilities capable of handling double their current volume, LEEF is prepared to scale as supply increases.

2025 Growth Strategy

LEEF Brands plans to leverage its California success to expand into new markets. While the company remains focused on dominating its home state, it recognizes the potential of higher-margin markets on the East Coast and beyond.

Key Drivers for Growth:

Expansion to New States: LEEF’s existing relationships with top cannabis brands provide a clear path to scaling operations in states where cannabis products command significantly higher prices.

Federal Rescheduling of Cannabis: While not essential to its strategy, the federal government’s expected reclassification of cannabis from Schedule I to Schedule III would unlock interstate commerce and banking access, creating a tailwind for LEEF’s growth.

Market Leadership: By continuing to serve as a trusted partner to California’s largest cannabis brands, LEEF is positioned to replicate its success in emerging markets.

Innovative Financial Strategy

LEEF Brands is embracing innovation not just in operations but also in financial management. The company has recently:

Added Bitcoin to Its Treasury: This unconventional move positions LEEF as a forward-thinking company, prepared to capitalize on the evolving financial landscape.

Closed a Private Placement: This provides the capital needed to execute its 2025 growth initiatives.

Launched a Bitcoin Placement with Canaccord: This demonstrates LEEF’s ability to attract interest from institutional investors and further solidify its financial position.

These steps reflect LEEF’s readiness to transition from stabilization to aggressive growth in 2025.

Why 2025 is LEEF’s Breakout Year

LEEF Brands is at an inflection point. After years of laying the groundwork—streamlining operations, securing critical assets like the Santa Barbara ranch, and weathering the challenges of the California market—the company is poised for profitability. Here’s why I’ve chosen LEEF as a top pick for 2025:

Margin Expansion: The integration of the Santa Barbara ranch and cost-saving measures will dramatically improve profitability.

Growth Potential: Expansion into new markets offers opportunities to replicate success and capture higher-margin revenues.

Undervalued Stock: With a market cap of just ~$25M US, LEEF offers tremendous upside compared to its peers.

Financial Stability: Recent placements and innovative treasury strategies position LEEF for sustainable growth.

The Value Proposition

LEEF’s value proposition is clear:

A proven track record of success in California, the nation’s toughest cannabis market.

A significant asset base, including the nearly 2,000-acre Santa Barbara ranch.

A strategic roadmap to expand margins, scale operations, and enter new markets.

As CEO Micah Anderson has explained, LEEF has spent years building a solid foundation, focusing on refining operations and securing critical assets like the Santa Barbara ranch. With plans to improve margins through cost reductions, explore innovative technologies, and expand into new markets, the company is well-positioned to deliver significant value to its investors in 2025.

Why Now is the Time to Invest

LEEF Brands is undervalued, underappreciated, and ready to take off. As they expand their margins, execute their growth strategy, capitalize on potential federal regulatory changes, and finally market to investors, we have the chance to get in at a time when the company’s valuation doesn’t yet reflect its full potential.

Thanks for reading Penny Queen’s Newsletter! Subscribe for free to receive new posts and support my work.

For more information visit: https://Stockspeak.com/stocks/leaf-brands

Send any questions or comments to: penny@8digitspeedrun.com

I am long LEEF Brands. I have personally taken a stock ownership position in the company via the open market. DISCLAIMER: I do not provide personal investment advice, and I am not a qualified licensed investment advisor. All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read and/or view. 45 Degrees, Inc has received 300,000 options as part of a consulting contract. 45 Degrees is owned in whole by a member of my family.

« 45 Degrees, Inc has received 300,000 options as part of a consulting contract. 45 Degrees is owned in whole by a member of my family. »

Paid promotion?

how is this stock part of "Disruptive and clean tech" ?