Can K92 Expand Without Stealing?

A $2.8 billion miner is trying to double production… but the land they need isn’t theirs.

Let me lay this out clearly.

K92 Mining (US OTC: KNTNF | TSX: KNT) is on track to become one of the biggest gold producers in the Asia-Pacific region. With a $2.8 billion market cap and a high-grade mine already producing over 150,000 ounces of gold annually, they’ve launched an aggressive multi-stage expansion plan to push that number above 400,000 oz AuEq.

But there’s a major problem.

Their preferred site for tailings, critical for any mine expansion, is not on their property.

That land is owned by South Pacific Metals Corp. (US OTC: SPMEF | TSXV: SPMC), a $32 million company that just won again in court.

Court Upholds South Pacific's Rights to EL2558

The National Court of Papua New Guinea just upheld existing injunctions in favor of South Pacific. The judge ordered that the protection remains in place until further order of the court and awarded legal costs to South Pacific as well.

Despite not holding the license, K92 intends to apply for a Lease for Mining Purposes (LMP) over this land. It’s either a show of confidence or a high-stakes gamble that could backfire dramatically.

Why This Land Matters: EL2558 and the Tailings Trap

EL2558 isn’t just a parcel on a map, it may be the only viable location for K92’s tailings facility.

You can scale up a mine, double throughput, and shout your growth plans from every investor rooftop…. but if you don’t have a legally permitted site for your tailings and waste rock, you’re stuck. Full stop.

K92’s expansion plan includes a 1.2 million tonne per year plant, already 70% funded and largely constructed. Commissioning is expected in soon.

But the plan relies on tailings disposal, and right now, their preferred location is blocked by a junior explorer that is not giving up.

What Happens Even If K92 Wins?

Here’s what most people aren’t thinking about:

Even if K92 prevails, South Pacific could file objection at several points in the process, delaying progress for years.

This isn’t Nevada. This is Papua New Guinea, where mineral rights, land tenure, and community consultation are deeply respected. South Pacific’s team is local, experienced, and determined to defend their ground.

And they’re not short on resources. They’re cashed up and actively exploring four separate, potentially company-making projects.

The Strategic Squeeze: K92 Is Surrounded

Here’s where things get even more interesting.

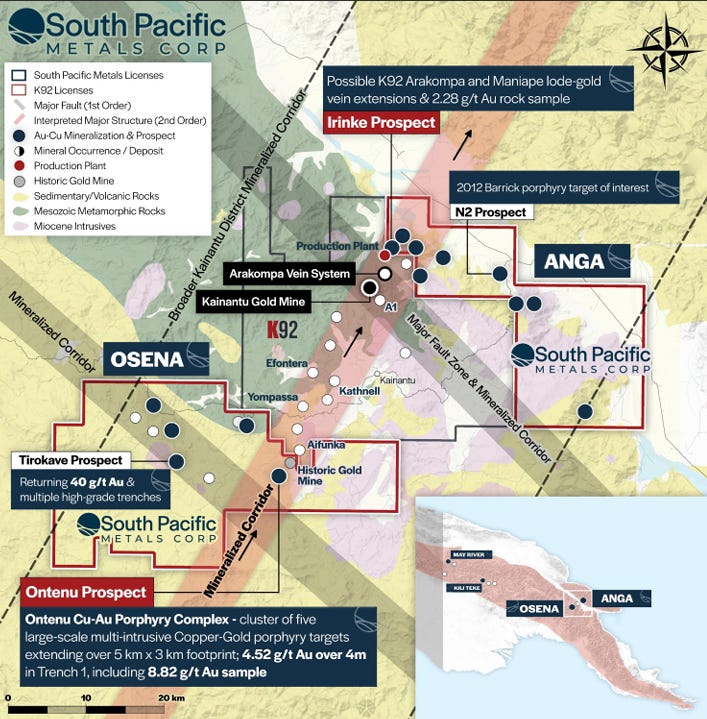

South Pacific controls the land immediately north-east and south-west of K92’s Kainantu operations, effectively bookending their project.

Anga, to the north, borders K92’s known mineralized corridor.

Osena, to the south, does the same.

These two projects act as strategic gates to K92’s future growth. If mineralization continues, and early samples suggest it might, K92 could find itself boxed in.

This isn’t just about tailings anymore.

South Pacific is sitting on geological leverage….and they know it.

South Pacific’s Results Tell a Story

South Pacific’s has already produced some notable numbers:

73 g/t gold

603 g/t silver

10.3% copper

These samples were collected from different locations, strengthening the case that K92’s mineral-rich trends may extend directly into South Pacific’s land.

Here are their latest results out this morning: New Mineralised Structures Found at Ontenu NE

KNT Stock Has Been Soaring …. But For How Long?

Since the start of 2025, K92 stock has soared from ~$9 CAD to over $16 — a 77% gain in just over 8 months.

Investors love the growth story. But they may be missing the fine print: the whole thing may depend on land that K92 doesn’t control.

By my math, if this expansion is delayed, re-permitted, or re-engineered, it could result in a 25% drop in K92 market cap. Right now, that would be about 700 million. Here’s my logic, a big portion of their gains this year appear to be in anticipation of the increase in production from 150k to 450k ounces, I attribute the rest to the massive rally that gold has seen. Lose the expansion, lose the premium.

What’s the Smartest Path Forward

From my view?

K92’s best bet might be to buy the project…. or the whole company.

South Pacific holds not only the tailings site but two flanking exploration projects with real potential. A full acquisition would remove the risk, secure future expansion corridors, and eliminate years of legal uncertainty.

But here’s the thing: South Pacific isn’t going to stay cheap for long.

They’ve been quietly assembling one of the most strategic portfolios in PNG. With 800 assays pending on the two projects nearest to K92 and massive holdings in Kili Teke (4moz equivalent inferred resource) and May River (drill holes the likes of 20m 13% CU and 2g/t AU from surface).

This is another one of Andy Bowering’s projects and if you are a mining investor, you probably know that he has a very hot hand.

Penny Queen’s Note (Read This)

I don’t normally write about mining companies as they tend to be slow burns and long stories. I personally need another layer, and the battle with K92 is it.

I am biased: South Pacific Metals is my largest mining investment. My family’s company also consulted for South Pacific Metals in the past. They’ve also signed an advertising contract, though there are no active campaigns right now.

This story caught my attention because it’s rare to see such a clear David vs. Goliath setup… where the David has both a slingshot and the legal title deed to the battlefield.

South Pacific isn’t just surviving. They’re winning.

Bottom Line

K92 wants Tier 1 status.

They’ve built the plant.

But the plan may hinge on land they don’t own.

South Pacific controls the license and the legal high ground.

And they’re not backing down.

This could be one of the most important court cases in the entire resource sector in 2025, and very few people are watching.

If K92 wants to control its destiny… they might need to write a check.

Because sometimes, the little guy prevails.

Note to My Followers

We just passed 2,300 subscribers here on Substack and are holding strong with a 50%+ open rate….a huge thank-you to every one of you.

Also, a few readers asked why I didn’t include $VIVS in my recent Year in Review.

Here’s the short version:

While $VIVS is currently up 239% from when I first presented it at a private conference (July 26 at $1.55 → a high of $5.26), it’s an extremely low float stock with only about 2 million shares.

That’s not something I feel comfortable highlighting to a large, public audience. VivoSim is, and remains, a swing trade, not an investment thesis. I didn’t intend for it to get out, especially out of context. Putting such a small float out to a large audience is a recipe for disaster. I have completely closed my position.

Shoutout to The Yellowbrick Road, who does excellent work and happened upon it organically. You should absolutely be following them, and I’ll drop the link here below.

Just know that this was never a long-term play, and I wouldn’t suggest chasing it at this point unless fundamentals prove out. For full disclosure here is the link: Penny Stowell YellowBrick VIVS Pitch

If you would appreciate swing trade posts, let me know and I’ll start.

Disclaimer

This article is for informational and entertainment purposes only and does not constitute investment advice. The opinions expressed are solely my own and are not a recommendation to buy, sell, or hold any securities. Always do your own due diligence and consult with a qualified financial advisor before making investment decisions.

I currently own stock in South Pacific Metals Corp. and my family’s company has a business relationship with the company through 45 Degrees, Inc., which has signed an advertising agreement with the company.

Pursuant to that agreement, 45 Degrees will provide advertising services, including Google Ads, social media content, and video interview distribution, to South Pacific Metals Corp. for a six-month term commencing July 29, 2025. In exchange, 45 Degrees has received compensation in the form of 150,000 options, each exercisable into one common share of the Company at a price of $0.55 and expiring on July 29, 2030. These options are subject to standard vesting provisions. The Company will also reimburse 45 Degrees for all pre-approved advertising expenses.

No active advertising campaigns are currently underway as of this publication date.

I want to be as transparent as possible about any potential conflicts of interest.

If SPMC are bought out by K92, what would be a reasonable price for that acquisition?