$ADUR Is Coiled Below Breakout, With Triple-Digit Fundamentals Behind It

Fibonacci, Float, and Fundamentals: The Case for Aduro Clean Technologies

Stock Therapy with Penny Queen • July 2 2025

Why the $48 Target Might Be Just the Beginning

Aduro isn’t just another cleantech ticker riding macro hype…. it’s a rare case where the technology, the economics, and the access are all in place at the same time. I’ve covered Aduro since before its Nasdaq uplisting, and while the short-term chart action is getting interesting, I want to zoom out first. Because there’s a case to be made that this is a triple-digit opportunity in disguise.

Independent analyst firm Boral Capital recently updated their price target on Aduro to $48 USD, citing the company’s differentiated Hydrochemolytic™ Technology (HCT), early revenue model, and exposure to a $200+ billion addressable market across plastics, heavy oil upgrading, and renewable fuels. This isn’t a moonshot fantasy, Boral’s number is rooted in real margins and actual engagement from major industry names like Shell and TotalEnergies. More importantly, their report emphasizes what makes Aduro stand out: Aduro’s system isn’t just effective, it’s uniquely flexible. The ability to process multiple plastic types and tolerate dirty feedstock isn’t just a technical advantage, it’s a commercial moat.

This kind of positioning is incredibly rare in small caps. Most companies still in the pilot or demo stage don’t have global partners paying them to test tech in real-world conditions. Aduro does. Most don’t have patents filed across multiple verticals, or revenue coming in while R&D is still underway. Aduro does. And most need years of dilution to cross the bridge from promise to product. So far, Aduro has kept dilution under 5% annually, with insiders continuing to hold every share they’ve ever owned. That’s a big reason I’m holding, and why I see the current $9 handle as an entry point, not an exit.

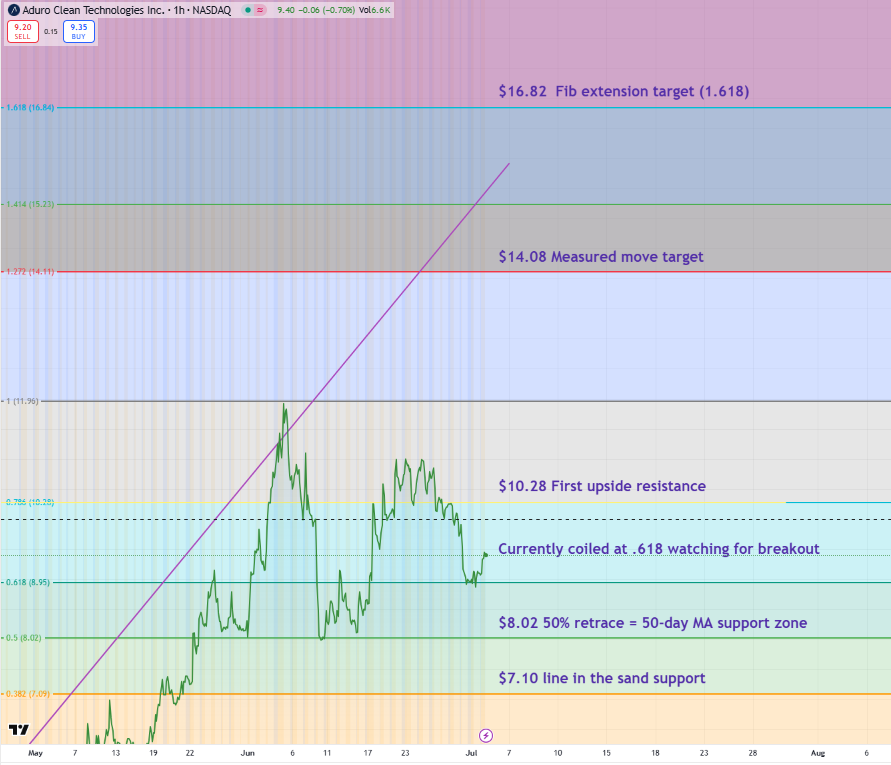

Now let’s turn to the chart. Because while the fundamentals justify a big-picture valuation, the technicals suggest we might not have to wait long to see liftoff.

Aduro Clean Technologies: Summer Triangle, Fresh Cash and a Tightening Float

Aduro just banked $9.2 million, unlocked listed options, and hired a 25-year NOVA Chemicals veteran…. all in three weeks. The float is two-thirds spoken for, and the stock is coiling above critical support

1 Tape check — triangle coil above the 38 % Fib

(insert your own clean daily-chart screenshot here — regular-session candles, low 24 Apr $4.08 to high 6 Jun $11.96, with Fib and converging trend lines)

Key prices:

$8.97 – 38 % Fib and lower triangle rail. A daily close here would mark the first real support test since the June highs.

$8.04 – 50 % Fib plus the latest higher-low cluster.

$7.21 – 61.8 % Fib and the 50-day moving average tracking toward that zone; a well-followed trader I know plans to double if we print $7.

$11.50 – ceiling of the prior range. A weekly close through it completes a textbook cup-and-handle and projects $16–17 by measured-move math.

Volume has fallen about 40 % from early June, yet liquidity remains multiples of the spring average - partly because a brand-new derivatives market just opened…

2 Options arrive, and they’re loud out of the gate

Nasdaq-listed ADUR options are listed the week of 25 June. In the first four sessions, open interest cleared 12,000 contracts, with a heavy flow in the August $10 calls and August $7.50 puts. Implied volatility greater than 150% tells us that institutions are paying up to hedge or gain exposure without touching the thin float.

3 Fresh cash and a veteran operator

US

-allotment (20 Jun) added 1.09 m shares at $8.44 and 0.55 m three-year $10.13 warrants globenewswire.comglobenewswire.com.David Weizenbach, P.Eng. - 25 years at NOVA Chemicals - becomes COO on 1 July after six months consulting on pilot scale-up globenewswire.com.

The raise leaves Aduro debt-free and funded well into mid-2026 even on high-burn assumptions, while Weizenbach’s plant-start-up résumé derisks the Q3 pilot launch.

4 Ownership: two-thirds verified….and probably climbing

✅ Total known ownership: ~66.5% locked up

<sub>¹ Basic shares outstanding after the 1.09 M-share June raise ≈ 29.43 M.

² New 13F/early-warning data should post by mid-August and will absorb part (or all) of the 1.09 M new shares if they landed in funds’ hands.</sub>

Take-away: insiders plus confirmed retail already locked up 66.5 % of the float. Assuming even half of the June financing settled with funds, real held-float would top 68 %, and a full institutional allocation would push it north of 70 % - numbers we can verify once fresh filings drop.

The hurdle to more institutional buying is the Aduro is currently valued at $286m, a size too small for most institutional mandates.

Daily trading volumes have been limited until recently; many funds can’t build positions without moving the price.

Liquidity screens and AUM thresholds often disqualify companies under $500M–$1B. So, I guess we have a double from here before meaningful institutions step in… sounds like a deal to me 🙂

5 Valuation frameworks

D. Boral Capital: Buy, $48 target on a 10-year DCF/diluted EPS blend assuming 0.5 % share of the $120 B advanced-plastics market.

Retail GPT deep-dive: Base case $145 on plastics royalties alone; $540 including heavy oil and renewables. (Link here)

Shareholder survey: Median 3-year objective $80; modal cluster $50–$75.

Even the sell-side “low bar” implies a 5× move from today’s $9 print.

6 Balance-sheet reset in plain English

Post-raise cash > US $10 m, no debt, and dilution only above the $10.13 warrant strike. On a post-money ~29.6 M basic share count, Aduro’s cash position now tops US $10 M, with no debt and warrants dilutive only above current levels.

7 Risks to keep in view

Pilot delay or yield miss could push demo timelines and dents credibility.

Partner slippage could force another equity raise in 2026.

Competitive creep: PureCycle’s PP focus and Agilyx’s PS advances might cap royalty rates if Aduro lags.

8 Trading map for the next quarter

9 Bottom line

With two-thirds of the float effectively spoken for, fresh cash in the bank, and a seasoned chemical-plant operator sliding into the COO chair, Aduro enters Q3 with the wind at its back. The technical picture shows a high-probability continuation pattern, and the brand-new options market is already signaling institutional curiosity. If the NGP pilot does what the bench chemistry says it can, today’s single digit share price will look like small change.

If you have any thoughts, please comment below or reach out: https://linktr.ee/PennyQueen

Disclosure: I am long Aduro. I have not been compensated for this article, which is for educational purposes only; always do your own due diligence. I am not a financial advisor, and this is not financial advice. Protect your capital, investing is risky.

thx a lot for sharing it. your YT interviews helped me a lot clear my mental fog. Appreciate your efforts.

LEDO

LEEF

CISO

ADURO

are your 4 major holdings? or Can i pls ask if you own some other stocks as well? thx